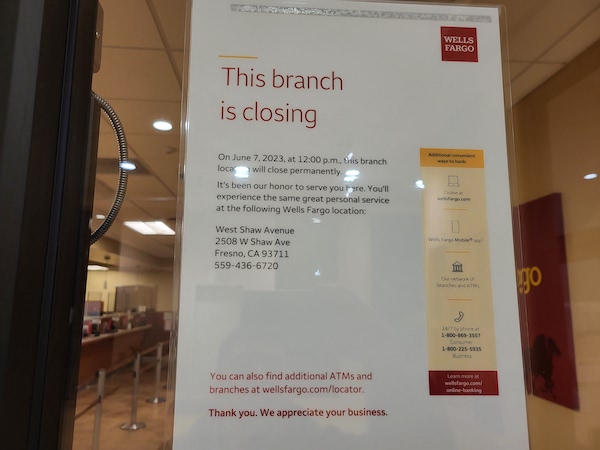

The Wells Fargo branch at Fresno's Fig Garden Village closes in June. Google Street View photo

Written by Alex Scott

The largest bank in the Central Valley is closing its Fig Garden Village branch later this spring.

The Wells Fargo location near the northeast corner of Shaw and Palm avenues will shutter effective June 7 at noon.

Mailers and a notice posted by Wells Fargo staff expressed gratitude to customers for choosing the location as their primary bank and encouraged them to use the next closest location following the closure.

According to the Federal Deposit Insurance Corp., Wells Fargo is the largest bank in Fresno, Tulare, Madera and Kings counties with nearly 21% of market share as of June 30, 2022.

It was a matter of consolidating in an area with branches operating near each other, according to a Wells Fargo spokesperson.

“Because we currently have multiple branches so close to each other, we are consolidating the Fig Garden location. We lease the Fig Garden space, so the landlord will make the decision on any future plans,” according to an emailed statement from Wells Fargo. “We continually evaluate our branch network, and make adjustments based on changing customer needs, market factors, and economic trends.”

For those banking with the Wells Fargo Fig Garden location, the next closest locations would be 2508 W. Shaw Ave. and 710 E. Shaw Ave., which are both approximately two miles away.

“Additional nearby branches include our branch at 2425 N Blackstone Avenue and our branch at 8420 N Friant Rd,” according to Wells Fargo.

When reached Thursday morning, a representative of Fig Garden Village was unaware of Wells Fargo’s plans to close the branch.

Bank branches have been closing left and right in the Central Valley. In 2017, the Bank of America branch in Fresno’s Tower District shut down. Similarly, the Bank of America in Kingsburg closed in 2018 as did the Lemoore location in July of that year.

According to S&P Global Market Intelligence, U.S. banks closed 95 branches and opened 46 in January of this year, bringing the total number of active branches to 78,806. Based on S&P’s data, net closures were significantly lower than the 12-month average of 161 net closures per month last year, and are now at 49 whereas in December 2022 it was 76. The outlet reports that branch closures have slowed, with banks becoming more balanced between shuttering locations and moving to a digital space in order to stay competitive.