Marshawn Goven, president and CFO of MK Insurance Agency & Tax Consultants, has unveiled a comprehensive banking app that rolls many services, from taxes to crypto, under one banner.

Written by Frank Lopez

The tax season is upon us, and while every taxpayer encounters some confusion when filing, the uphill tax battle is even steeper for businesses.

A local tax and insurance consulting agency has launched an app to make the filing process for personal and business owners quicker and simpler.

MKG Insurance Agency & Tax Consultants, with two locations in Fresno, released its banking-as-a-service tax app for both the IOS and Android platform in February.

President and CFO Marshawn Govan said it was important to launch the mobile app during Black History Month to honor the contributions African-Americans have made throughout history — and to recognize the fight for racial justice going on to this day.

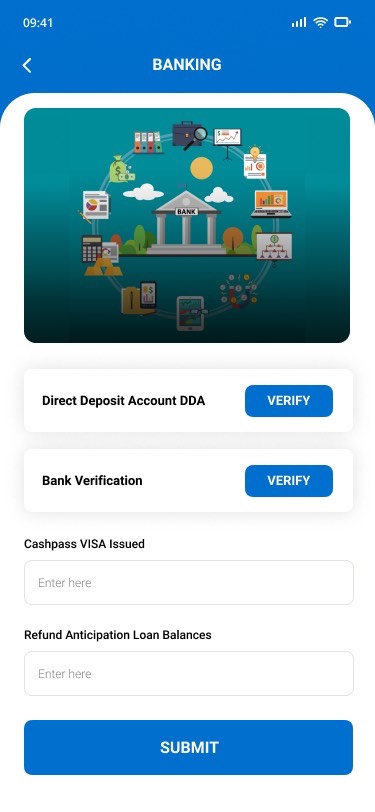

The app allows users to open bank accounts from their mobile phone, send and receive ACH (Automated Clearing House) payments, pay bills and manage cash flow securely online with an FDIC-insured business bank account.

The new app is a rebuild from an old version with an IBM license—meaning MKG didn’t own the source code for app. The new app was built specifically for MKG, meaning there is no limit for the license and no costs to renew it.

Most tax companies with mobile apps use third-party developers, leasing the software as a service.

“We are originators and developers of what we have in the market,” Govan said. “We can also branch out, white label it and offer that as a software service to other tax companies — to a bank looking to become a green product.”

The app also helps consumers start the process of buying a home.

Govan said the goal is to help underprivileged and underbanked families access credit to affordably finance auto loans, home improvements, home solar systems, down payments, investment and paying off debts.

While it is unique that a local tax and insurance agency has its own specifically developed app, MKG also offers crypto tax service.

Users will be able to buy, sell and exchange crypto currency. The company even launched its own crypto-token — Token MKG Enterprises.

According to Govan, no other tax firm is offering a crypto token.

The app also features money-wiring services such as Cash app and Venmo.

Users that are business owners will be able to open a business banking account, send and receive money and make check deposits — much like other banking apps on the market.

Currently MKG is doing regulation crowdfunding, allowing retail investors that might not be accredited to invest smaller amounts. With smaller investment amounts, Govan said it gives them an opportunity to share in the company’s future growth without them having to invest a large part of their finances.

MKG is preparing to go public in 2022 to be listed on the OTC market. Govan said that investors have the opportunity to invest now before it grows.

Govan said there are a lot of barriers for Black people and other underserved communities regarding financial equity, and the FinTech industry is not one where Black people normally dominate.

This makes it difficult for many in communities of color to have access to capital for home loans or business loans.

“We want to show businesses in the Valley a path,” Govan said. “ We could become a Silicon Valley in Fresno, but it takes the right companies, the right mindset and having the resources, and getting the information out there for people.”