Train photo by unSplash.com user Eddie Bugajewski.

Written by Frank Lopez

The word “port” evokes images of a quaint harbor town with docks edging the sea.

But a proposed distribution and transportation project for California — one which will have components in the Central Valley — could be a model for inland ports in the U.S.

It should be noted that a port doesn’t necessarily need to be surrounded by or connected to water.

An inland port, or dry port, is an inland logistics and distribution hub. An inland port also refers to a port on an inland waterway — rivers, lakers or canals — that may or may not be connected to the sea.

According to a 2016 Inland Ports Logistics annual report published by commercial real estate firm CBRE Research, there are only a dozen such facilities in the nation that are non-seaside with rail-based infrastructure.

Spearheading this $30 billion proposal for a “California Inland Port System,” are private investors and interests in economic development, energy, transportation, shipping and engineering.

Participants and partners include the Fresno Council of Governments (COG) as the public sector manager and coordinator; Arizona-based Global Logistics Development (GLD) Partners for economic development and public-private partnership and Texas-based firm Jacobs Solutions for engineering, planning and clean energy.

Nodes of transportation

Simran Jhutti, associate regional planner for Fresno COG, said the private sector has reacted with enthusiasm for the inland port project. Shippers have voiced the need for improved supply chain reliability, lower costs and development of comprehensive logistics and investment hubs.

“The business strategy for the project is robust and is an extraordinary example of public and private forces working together, with public investment acting as seed funding and unlocking vast private investment,” Jhutti said.

Public investment for the project is expected to reach $200 million, leveraging an anticipated $30 billion from the private sector.

Other partners include companies in rail system planning and infrastructure, truck manufacturing and telecommunications.

Planning for the California Inland Port began in 2019. It is expected to be in operation by the end of 2024.

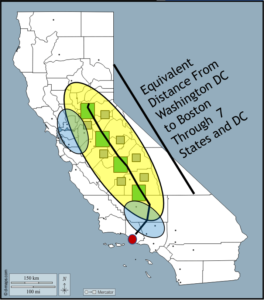

The system is actually a 425-mile corridor that will stretch from the ports of Los Angeles and Long Beach up to Sacramento. It consists of four major inland hub ports and seven smaller satellite ports, creating a multi-modal network of integrated clean and automated truck, rail and cargo facilities.

No sites have been publicly announced.

Jhutti said the project has a potential to create 100,000 jobs.

Along with restoring shipping and distribution channels disrupted by the Covid-19 epidemic, the project will reduce the number of truck trips from the Southern California seaports into the Los Angeles region, the Central Valley and Bay Area, reducing vehicle miles traveled and emissions.

Clean transport, clean communities

Scottsdale, Arizona-based GLDPartners is an international advisory firm for manufacturing companies, public and private logistics and property asset owners and investors for projects such as the California Inland Port System.

Adam Wasserman, managing partner at GLDPartners, said that to establish a project like the inland port, the market must have a dense cargo network with public policy adjectives toward better logistics and supply chain activity.

“The customized proposition in the California Inland Port tries to be beneficial to business and very beneficial to the public side with traffic reduction, safety and improving the air,” Wasserman said. “If we do it right, we think there is an opportunity to create significant economic growth or attract the sorts of investment that usually doesn’t consider California as an investment location.”

Wasserman said this will give the Central Valley a chance to find investment that hasn’t been present in the region before.

Even with the Central Valley’s relative closeness to the port complex of Los Angeles, there is still a challenge to get there, Wasserman said, especially with fuel costs, trucking regulations, congestion and the costs of truck drivers.

But with a lot of cargo moving out of the Central Valley, especially agricultural and food commodities, the area is uniquely positioned with a large market and easy access to global distribution channels, making it an ideal baseline for creating a logistics system.

There are not many examples to compare with the proposed port, Wasserman said, making the California Inland Port a trailblazer.

“There’s nothing like this anywhere,” Wasserman said. “We think it will be the most efficient, cleanest, most robust, technologically advanced logistic system anywhere.”

This is now possible, Wasserman said, because we now have the technology to do it and future-proof it for the next generation.

Tech paves the waves

On the logistical end of freight and shipping is Texas-based rail logistics provider Commtrex.

The tech-enabled online marketplace serving the U.S. and Canadian rail industries creates efficient and liquid transportation markets with its proprietary technology, improving how shippers manage their rail fleets and move freight.

Commtrex CEO Martin Lew founded the business in 2015 after working as a commodities trader for JP Morgan and Bear Stearns, where he first got his exposure to the industry and deficiencies with how freight is moved by rail.

He knew the role evolving technology would play in the industry and wanted his platform to connect all rail-served shippers to every rail-served terminal and warehouse across the U.S., Canada and Mexico.

In the last six months, Lew said that his company has moved into physical freight logistics, providing services for moving and managing freight for shippers.

Lew said that Commtrex is the only company that all seven Class 1 railroads partner with and endorse.

Transloading — the movement of freight from one mode of transportation to another — was the service most searched by clients of Commtrex, showing how critical it is to the supply chain.

“These terminals, these ports, these transport facilities — if they don’t have rail-served facilities, you need to go to a transloading company,” Lew said.

Industries such as lumber and manufacturing must get their products as close as they can to customers, and if customers don’t have rail-served facilities, shippers will need to find a transloading company or port to ship their products.

Lew said rail is the cheapest freight for any delivery over 300 miles.

Building more inland ports will create a more efficient shipping system.

“Think of transloading as the terminal and ports as nodes on a network of airports,” Lew said. “The more nodes in Southeast Airlines or American Airlines, the more places they can stop, the more places passengers can be carried. It’s the same exact thing for rail.”

With more terminals in ports and transloading facilities, transportation companies will have more opportunity to grow their footprint and expand their network of reachability.

Historically, the U.S. government has not invested significantly in inland ports because overall, there is a lot of infrastructure that needs to be built across the nation, and they have not been highlighted enough by companies in the industry.

In the past, shippers and transportation companies were able to manage with their existing ports, warehouse capacity, truck capacity and infrastructure, but the Covid-19 disruption and other economic factors are forcing a redirection of strategy.

Lew said he sees inland ports as a rising trend.

“The demand is there,” Lew said. “From shippers moving the products — consumer goods or industrial and energy products — the demand will help facilitate railroads to want to partner with shippers and then either with state governments, local economic development groups and third-party private capital.”

These factors, Lew said, create “The Perfect Storm.”