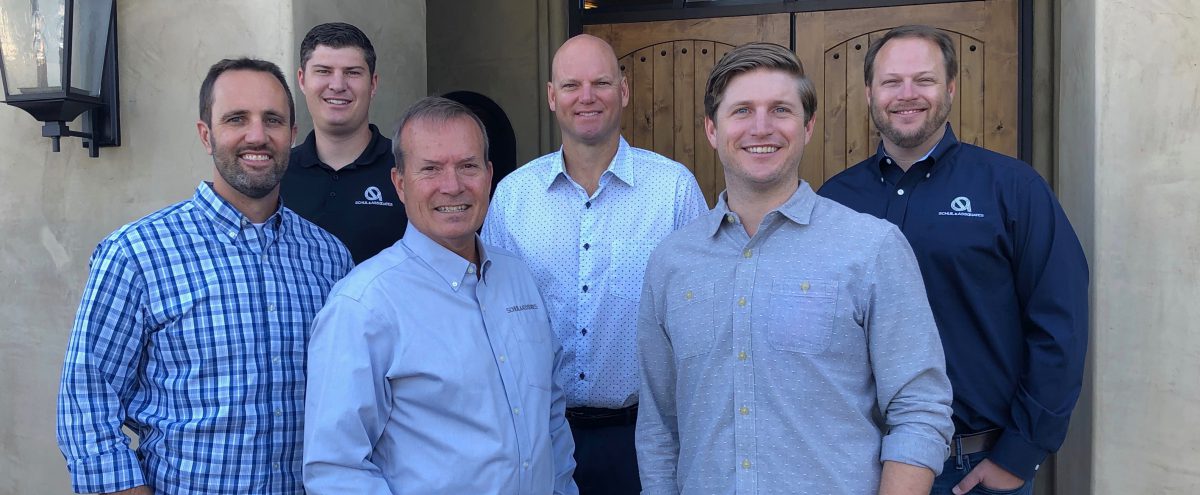

Front, left to right — Doug Phillips, Arnel Koster, Scott Schuil; back, left to right — Jonathan Verhoeven, Phil Heynen and Stephen Schuil. Photo contributed

As a Visalia real estate brokerage surpassed 36 years in business, the leadership began to evaluate what it would take to keep going for another 36 years.

The three brothers who once owned Schuil & Associates Real Estate now share their executive positions with six other agents from the firm. They decided that in order to secure the business into the future, it would take getting their best producers involved in the leadership process.

“We could have continued to run it until we were 82 and decided that was that,” said Rick, board chair. “We could disappear and hope that there’s a transition into the future. But this way — the vehicle, the model, it’s in place and it will move.”

Rick and his twin brothers Marc and Mike started the company in 1983. Since then, they have become one of the biggest dairy brokerages in the Western United States, Rick said.

Succession is something business owners “just don’t think about,” said Ashley Jacobsen, senior manager at accounting firm Moss Adams in Fresno.

“It’s something you really need to start planning for early before you think you need to,” she said.

With the future of the real estate firm laid out, the Schuil brothers can transition smoothly to the next generation. Of the nine shareholders, four make up the executive team. Along with Rick and Marc are Stephen Schuil, Mike’s son, and Doug Phillips, an agent there for 10 years. Making up the shareholders are Mike’s other son Scott, along with three others who were made shareholders — Arnel Koster, Phil Heynen and Jonathan Verhoeven.

“We value them as an integral part of this company by bringing them in as ownership,” Marc said. “It tethers Doug closely now, as closely as I am with the last name Schuil.”

Establishing leadership roles early is important, Jacobsen said. Doing the vetting, paperwork and evaluations for succession can be like taking on a second full-time job.

“Running the day to day operations of their business takes a tremendous amount of their time and focus,” said Jacobsen of business owners. “If they’re not looking at what’s going to be happening in terms of succession and the future, then they’re really just looking at the current here and now and keeping their head above water.”

One husband-and-wife company Jacobsen helped transition had been in business for three decades. They wanted to sell the business to start a new venture. They had become so used to handling major decisions that when the transition happened, they were forced to stay on for another year in an advisory role.

The Schuils began the transition process at the beginning of 2018. Instead of a financial consultant, they contracted with a psychological consultant with a business background.

“We wanted to get a sense, as the original owners, of what people’s expectations were,” Marc said. “How they would view being an owner of a company or not.”

“Business chemistry is a really important piece of it,” Jacobsen said. “If you spent your life building up your business, you want to make sure the individual you transition to is going to continue to operate in a way that will make you proud.”

Jacobsen participated in The Business Journal’s recent “Breakfast with Experts” event, where she discussed some of the challenges facing businesses’ succession plans. A business owner approached her after the event to talk about his experience. He told her that he had ended negotiations with a buyer simply because he did not like the way the potential successor answered a question.

The consultant for Schuil interviewed everyone, from the office manager to each of the stakeholders, returning to the brothers their recommendation.

Once they established who would be involved, they then had to figure how to involve them. They had to establish the value of each share and how much to give up.

“We weren’t sure how that would look like. How much of the company do we give up? Half? More? Less?” asked Marc. “They were all just brand new questions that we had not discussed earlier.”

The new S-Corp formation began Jan. 1, and it took a little bit for everyone to fill in his new roles. For Mike’s son, Stephen, he had to get used to being a decision maker.

“I just remember the first meeting, I didn’t even know how to talk,” he said. “Initially, it was a little overwhelming because we’re actually taking minutes for our board meeting. And so I’m actually a part of this.”

Both Rick and Marc said they have to remember they are now part of a board. Where at one time if they wanted to donate to a charity through the company, they would simply do so, now they have giving policies outlined in the bylaws. The six shareholders can now outvote the three brothers.

Bringing in new blood means new perspectives.

“Everything’s changing and we’re trying to be at the forefront of that,” Phillips said. “We’re tackling that head on and wanting to make sure we don’t fall behind.”

The company is rolling out a new app for clients. They are also working on their online presence and looking for a social media manager.

“We’re trying to get our Google scores higher so when people search us, they’re able to find us,” said Stephen. “When they’re searching any kind of farm land, they’re coming to us.”

Where once real estate sales depended solely on relationships, the internet has made online presence a must for brokerages — something the brothers hope younger leadership will execute.

The new succession plan eventually phases Rick and Marc out of leadership roles. By age 70, the executive committee will do the major decision-making.

“That was intentional to ensure that there would be a company. We do want a legacy,” Rick said. “We didn’t set the company up for a 40-year run. We want it to continue 40 plus 40, and maybe another 40.”