Written by Noble Credit Union

Hi, Neighbor! Whether you are near or far, Noble Credit Union is always close by. With branches conveniently located throughout the Central Valley, and a vast network of over 30,000 ATMs, Noble’s technology will keep your money accessible with just the touch of your finger.

What does this mean for you, as a business owner?

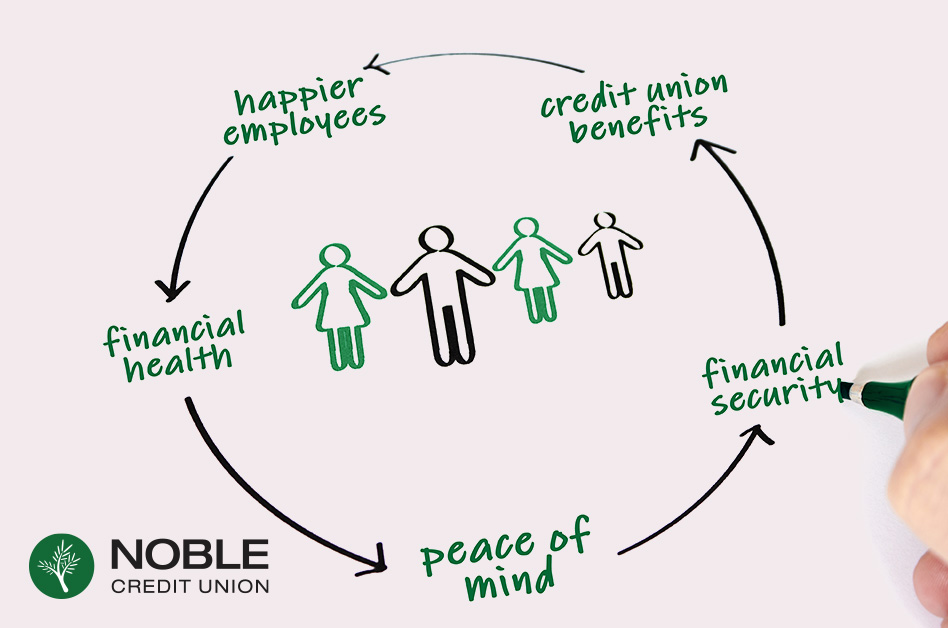

Noble Credit Union offers a unique partnership to local businesses and non-profit organizations. As you know, your employees help make the world go round! And after a year like 2020, this is more apparent than ever. For many of us, health has become a renewed priority. But health encompasses more than just physical well-being; it includes financial well-being, too. Financially stressed employees are 5x more likely to be distracted by their finances while at work. * But there is something you, as a leader, can do to help! Join hundreds of local organizations by quickly and easily offering your employees financial peace of mind by becoming a Noble Business Partner…all at no cost to you.

Unique and exclusive offers your employees will appreciate.

When a company partners with Noble, their employees are then eligible to become Credit Union members! They will also have access to special promotions and unique offerings created uniquely for them. You will have the ability to set up free live virtual financial workshops provided at a date and time that is most convenient for your team. And each participating company can receive a custom employee education portal with access to virtual financial coaches, real world simulations for kids, teens and adults, interactive calculators, and over 90 educational articles. And soon, the ability to schedule a virtual appointment directly with a Credit Union representative to ask questions, open an account, apply for a loan, and more!

Give your team account access beyond the branch.

Noble Credit Union has taken online and mobile banking platforms to the next level. Noble members have the ability to transfer funds between their own accounts, pay bills, send money to family and friends by using Zelle©, and can even move money to other financial institutions. Members can also easily and securely connect their credit or debit card information to their mobile devices, creating a mobile wallet. And for greater peace of mind, the mobile app gives the opportunity to activate and deactivate their cards at any given moment. Convenience, efficiency, and safety at their fingertips!

Flat tire? Broken cell phone? Noble can help with that, too!

While roadside assistance may not be something typically associated with a financial institution, Noble knows the usefulness of this real-life benefit. Roadside assistance is just a call or text away. The same can be said for Noble’s cell phone protection plans. These are just some of many unexpected perks that you won’t find anywhere else!

Becoming a Noble Business Partner is quick and easy!

It just takes minutes to partner and give your team the resources that could help them be more focused, less stressed, and thankful for financial benefits that go beyond the expected. Did you know 60% of employees would be more likely to stay at a job if their employer offered financial wellness benefits? * So, what are you waiting for? Become a Noble Business Partner today!

Contact Carin Hodge at CarinH@NobleCU.com, or by phone (559) 289-3664. The Business Development team looks forward to helping you bring financial health, wellness and peace to your workplace.

*PwC 2019 Employee Wellness Survey