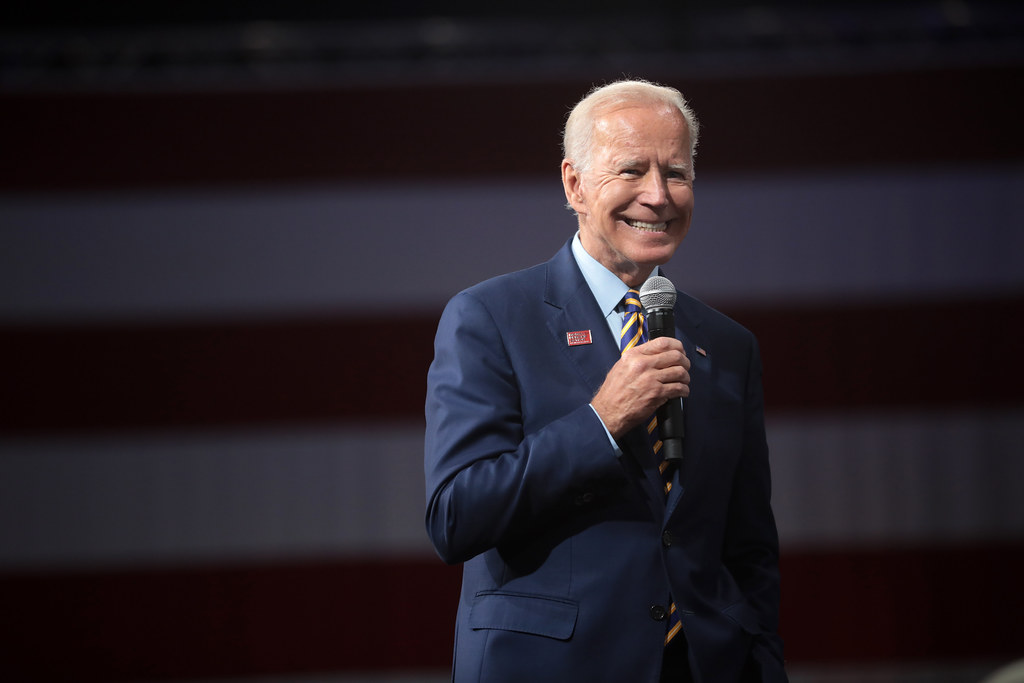

Joe Biden image via Flickr user Gage Skidmore

Written by Breanna Hardy

More help is on the way for small businesses after President Biden signed the $1.9 trillion American Rescue Plan Act of 2021 into law March 11.

The Rescue Plan provides additional relief for small businesses and hard-hit industries. It will infuse an additional $7.25 billion into the Paycheck Protection Program (PPP).

Some $15 billion will also be put toward the Targeted Economic Injury Disaster Loan Advance (EIDL) Program, expanding eligibility for larger nonprofits and online-only news outlets. Of the $15 billion, $5 billion will be put toward especially hard-hit businesses for Supplemental Targeted EIDL Advance payments .

Additional funds are also allocated toward the Shuttered Venue Operators Grant payments, and businesses can now apply for both the grant and the PPP.

As of Friday, Small Business Administration disaster loans made in 2020, including Covid-19 EIDL, will not have to make the first payment until 2022. Payments were originally due Dec. 31, 2020; that date was deferred to March 31, 2021, and now will be deferred to March 31, 2022.

But interest will still accrue until then.

“The American people and the nation’s Small Business owners need our tireless effort and dedication to get this essential funding to those in great need, and SBA will not rest until we implement President Biden’s ‘American Rescue Plan’ and its additional targeted programs and funds allocated for America’s small business and nonprofit communities,” said SBA Senior Advisor Michael Roth.

Covid-19 EIDL funds are offered at a 3.75% interest rate for small businesses and a 2.75% interest rate for nonprofits with a 30-year maturity. Interest will continue to accrue during the deferment period and borrowers may make payments if they choose.

Restaurants are also getting substantial help – $28.6 billion – for the Restaurant Revitalization Fund to provide grants in the industry.

National Restaurant Association’s Sean Kennedy hosted a webinar with the U.S. Chamber of Commerce. He said that unlike the PPP, the grants will not go through banks. Restaurants with more than 20 locations are not eligible. Publicly traded companies are not eligible, but franchises of publicly traded companies are.

Though the SBA has not released guidance specifically about the program, Kennedy recommends getting a Dun and Bradstreet D-U-N-S number and a System for Award Management (SAM) number ahead of time.

The SBA also introduced the Community Navigator pilot program, where $100 million in grants will go toward eligible organizations supporting efforts to improve access to Covid-19 pandemic