SBA to require citizenship verification for loans; local lenders say compliance will continue

Small Business Administration Facebook photo

Written by Dylan Gonzales

The U.S. Small Business Administration (SBA) announced Thursday new measures to ensure its lending programs are only available to applicants who pass a citizenship verification.

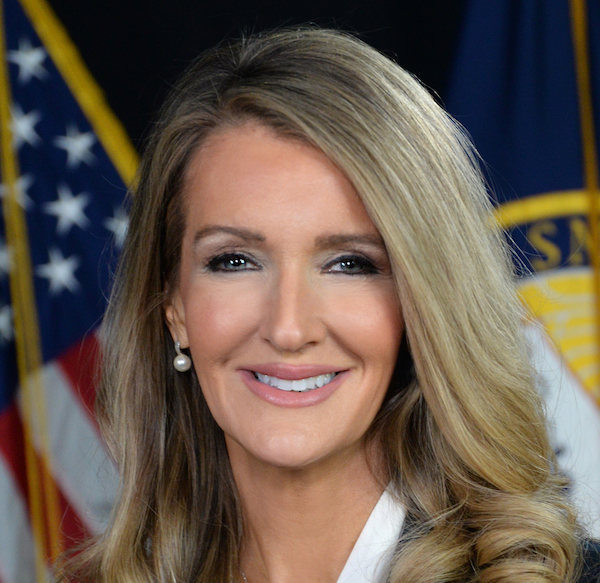

Kelly Loeffler, sworn in as SBA administrator on Feb. 20, also announced that six SBA regional offices would be relocated from so-called sanctuary cities.

In the coming months, the offices in Atlanta, Boston, Chicago, Denver, New York City and Seattle will relocate to “less costly, more accessible locations that better serve the small business community and comply with federal immigration law,” said Loeffler, a former fintech executive and U.S. Senate appointee.

Loeffler added that the SBA in the coming days will circulate a new policy requiring SBA loan applications to include a citizenship verification provision to ensure only legal, eligible applicants can access programs. Lenders will be required to confirm that applicant businesses are not owned “in whole or in part by an illegal alien,” consistent with President Trump’s executive orders, according to an SBA news release.

A pair of local lenders confirmed applicants for SBA-guaranteed lending programs are thoroughly vetted, including for legal status.

Steve Miller, CEO of the Fresno-based FFB Bank, said current SBA regulations require borrowers to be U.S. citizens or lawful permanent residents.

FFB Bank was No. 2 on The Business Journal’s list of SBA Lenders published in June 2024. FFB Bank approved $16.8 million in SBA 7(a) loans from October 2022 through September 2023.

Frank Gallegos, executive director of Cen Cal Business Finance Group, added, “We have always asked the citizenship question, and we verify their identity.”

Gallegos said the industry is awaiting additional guidance on whether the new policy will impact permanent resident applicants.

“The SBA is our regulator and we will comply with all of their requirements,” Gallegos said.

He noted that nearly one-third of their loans go to legal immigrants.

“At Cen Cal Business Finance Group, about 30% of our loans are made to individuals who were born outside of the U.S. and legally immigrated,” Gallegos said. “ We are proud to have provided financing to these individuals who are living the American dream of business ownership.”

Cen Cal Business Finance Group was No. 3 on our SBA Lenders list with $12.9 million in loans approved in fiscal 2023.