Farm land photo by Karsten Winegeart on unsplash.com

Written by Frank Lopez

Uncertainty looms for the financial health of farms across the country and in the Central Valley as ag bankruptcies rise.

The latest data from the United States Courts shows a total of 216 American farm bankruptcies filed in 2024, up 55% from 2023.

However, that’s still lower than the all-time high of 599 fillings in 2019.

Last year marked the end of a four-year downward trend in farm bankruptcies filed under Chapter 12, which offers farmers and ranchers flexibility in paying off debt when all other options have been exhausted.

California had the highest number of Chapter 12 filings in 2024 with 17 cases, up 54% from the year prior.

Peter Fear, bankruptcy attorney with Fear Wadell, P.C. of Fresno, said the last 12 months have seen a notable spike in filings.

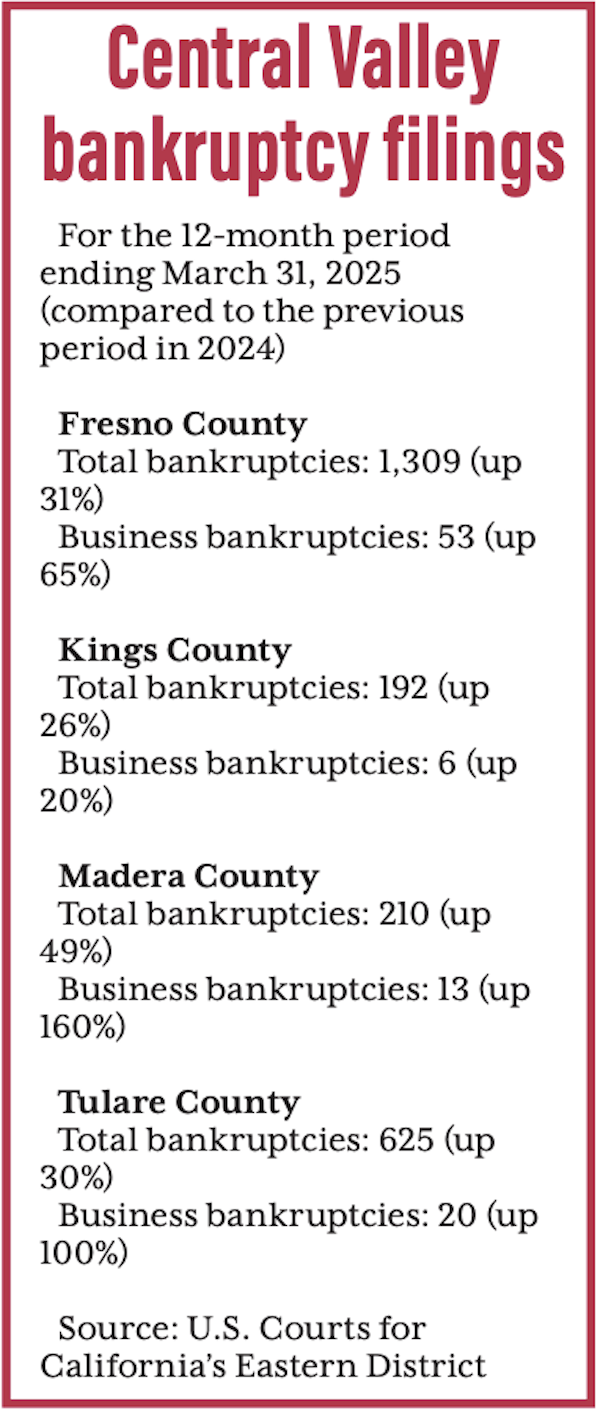

In Fresno County, business bankruptcy filings were up 65% for a total of 53 in the 12-month period ending March 31, 2025, according to U.S. Courts data.

For the first three months of 2025, California’s Eastern District Bankruptcy Court — which includes the entirety of the San Joaquin Valley — saw six Chapter 12 filings. There were four in the same period of 2023.

“It’s been building for a number of years,” Fear said. “Inflationary pressures that happened after Covid have made costs for farming go up.”

One of the biggest factors is the Federal Reserve increasing interest rates, he said.

Sale prices of commodities have also gone down substantially, Fear said, especially for almonds.

Around 2018, when prices for almonds were higher, a lot of leveraged investment was put into almond acreage.

Fear said borrowers are now paying up to double the interest with depressed prices on their initial crops.

Higher labor costs are also a factor, but that’s a consequence of inflationary costs, Fear said.

Matt Pennebaker, CEO and founder at Advanced Ag Realty and Appraisal in Reedley, believes farm bankruptcies will continue — even with recent increases in almond prices.

He has seen a reduction in land values of 25-50%.

“You have to plan for downturns and cycles that we know we have,” he said. “ Commodity prices for almonds in the past 10 or 20 years — you can see those cycles and when they’re coming.”

Pennebaker doesn’t think the bankruptcy trend will last long.

The crop that has it the worst is wine grapes as a smaller number of Millennials drink wine, weakening the market.

Farmers will contend with tight margins for the next couple of years, but as prices rebound, the farmers that didn’t over leverage themselves should be in a good position.

There aren’t too many big investment firms still around that are eager to buy land that is not really cash flowing, he said.

It’s mostly local buyers wishing to expand their operations or on the lookout for a deal.

“Now that prices are coming down, neighbors are taking a harder look at properties and incorporating them into their other farming operations,” Pennebaker said.

Dairy farmland has enjoyed a more stable market, Pennebaker said. A few years back, when dairy farmers began to realize the need for diversification, many began producing crops not only for their own operations but also for sale to other dairies.

Some dairy farmers have planted pistachio and almond crops in recent years.

Dairy farmers who survived the big bankruptcy period were able to hold steady as long as they had two sources of water, he said.

Banks and lenders are requiring more money now than they traditionally required, going up from a 35% down payment to a 50% down payment, Pennebaker said.

That’s an insurmountable barrier for some farmers, he said.

Pennebaker said he has noticed a lot more government backed loans via the Farmer Mac program, which provides a secondary market for agriculture real estate mortgage loans, rural housing loans and rural cooperative loans.

“It’s a different environment,” he said. “The low commodity prices and higher interest rates are the key to the foreclosures and it will probably continue until things stabilize.”