Jake Soberal and Irma Olguin Jr. leave a federal courtroom In November 2023. Photo by Estela Anahi Jaramillo

Written by Estela Anahi Jaramillo

Bitwise founders Irma Olguin Jr. and Jake Soberal pled not guilty Thursday in their first court appearance to charges under an alleged $100 million fraud scheme.

The charges are the culmination of FBI and IRS criminal investigations with a parallel civil investigation by the Securities and Exchange Commission.

An FBI official said corporate executives engaging in deceptive practices erode trust in their sector and within their companies, leading to their demise.

FBI Assistant Special Agent in Charge Crosby Brackett said at a news conference Thursday that the evidence against Olguin and Soberal is overwhelming.

“The result of their actions was the inevitable collapse of what was an unsustainable Ponzi scheme,” Brackett said.

Both were granted pretrial release, and will have a preliminary hearing on Jan. 25, 2024. A status hearing will be held on Dec. 8. The conditions for their release include surrendering passports and limiting travel to approved locations. No contact is to be made by Olguin and Soberal to former Bitwise board members and administrators. They cannot contact any witnesses, which may include Bitwise investors.

As part of the conditions for release, each put up a property bond. Olguin’s equity was her mothers home; Soberal’s equity was the home he currently resides in.

The complaint alleges that Olguin and Soberal agreed to deceive board members, investors, lenders and others about Bitwise’s finances. In order for Bitwise to obtain an additional $5 million investment from an investor, Olguin and Soberal altered bank statements by inflating the amount of cash that Bitwise had in its accounts and provided the altered statements to the investor, according to investigators.

Phillip Talbert, the U.S. Attorney for the Eastern District of California, said the defendants provided similar false statements to other investors to obtain additional funding and to the board of directors to allow them to continue running the company.

“Despite the massive influx of investment money into the business, Bitwise’s financial condition worsened. Instead of acknowledging that the business was failing to achieve the hope for returns, the defendants, Olguin Jr. and Soberal, repeatedly lied to the Board of Directors, investors, lenders and others about the business’s revenues and financial condition,” said Talbert.

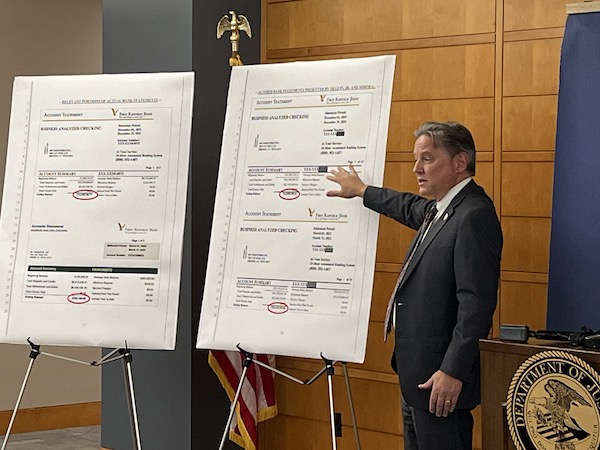

During the press conference, Talbert provided allegedly altered bank statements next to the real bank statement to show the discrepancy.

An allegedly altered bank statement from March 2022 showed a cash balance of more than $23 million. The actual bank statement showed only $325,000, said Talbert.

When one investor’s representative asked for the results of a third party audit of Bitwise’s finances, Soberal told him the audit was still in progress, Talbert said. The audit had actually been completed, but did not support the statements made by Soberal about the company’s financial condition. Soberal later provided the audit report to the investor after altering its date to make it appear it was only recently completed, Talbert alleges.

After the court hearing, attorney Roger Bonakdar, who represents former Bitwise employees in a separate lawsuit, said his team has been tracking Olguin through multiple counties in multiple states and were finally able to serve her in open court, he said.

“I am a little disappointed that they were released today,” Bonakdar said. “The amount of the fraud and the losses alleged in the complaint are very substantial. Typically you would see someone charged with this level of a monetary loss being held or substantial bonds being put up.”