Written by Brett Visintainer CCIM

Commercial real estate has seen a huge slowdown in 2023 in both sales volume and total transactions. CoStar notes that there has been a 53% reduction in sales this year compared to last year — the steepest U.S. property investment pullback since 2009. Interest rates have risen sharply over the last few months, where 7.50% – 8.50% interest rate is not out of the norm, making it difficult for investors’ numbers to pencil with cap rates below the cost of borrowing.

Investor holdback and a looming 2024 election will create a wait-and-see attitude while investors patiently watch how things shake out with the direction of the country. The headwinds investors are facing do not seem to be easing anytime soon. However, there are going to be a lot of opportunities as investors with debt maturing may find it hard to refinance with higher interest rates, lower loan-to-value ratios from lenders and valuations lower than expected.

Central Valley Multi-Family Market

Sales velocity and volume in the first three quarters of this year saw a significant reduction, with velocity dropping by 50.57% and volume by 49.19% compared to the previous year. The most recent time with lower velocity and volume dates back to 2013. Additionally, the average cap rate for the third quarter was 5.52%, a decrease of nine basis points compared to Q2 2023, yet remains 88 basis points higher than Q2 2022. Cap rates are higher but have not yet reached the pre-pandemic levels of 2019, which had an average cap rate of 6.41%. The graph below shows the total sales volume for multi-family transactions, which was $95 million in Q3. The last three quarters are significantly below previous years.

Central Valley Retail Market

For multi-tenant retail, cap rates compressed slightly from last quarter’s decompression trend, with the average cap rate falling to 6.71%. Of the 14 transactions in the Central Valley, only two properties sold below a 6.50% cap rate with the highest sale being a 7.25% cap. Deal velocity nearly halved from last quarter at 44% and marks the lowest transaction volume since the fourth quarter of 2020. These factors were heavily influenced by the total of 14 sales, which hasn’t happened since the beginning of the financial impact of the COVID pandemic in the second quarter of 2020. Lakewood Plaza highlighted the notable sales for the quarter trading at $8,070,651 and at a 7.25% cap rate.

Single tenant retail has seen deal velocity surge by 58%, reversing a downward trend of the past two consecutive quarters. Cap rates increased to an average of 5.69%, but we continue to observe a large spread between high-quality grade investment tenants trading lower than a 4.5% cap rate and smaller operators with larger footprints trading above a 6% cap rate.

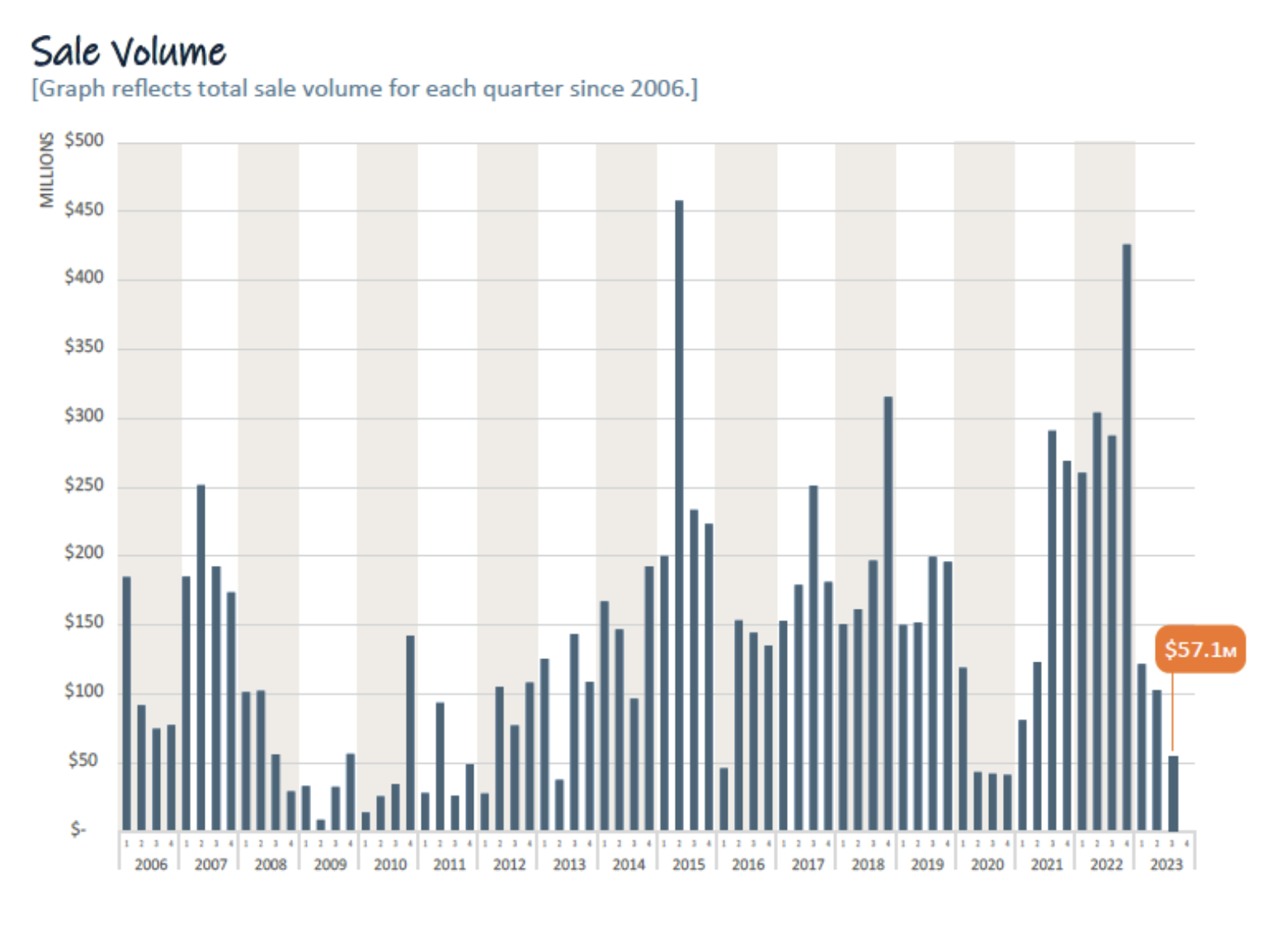

The graph below shows multi-tenant retail sales volume. There was only $57.1 million sold in Q3, back to COVID type numbers.

Consult with an Investment Advisor

Market volatility can create complexities in commercial real estate investing. Consult with an experienced advisor who understands your financial goals and can provide market expertise, with an understanding of elements that impact value.

Brett Visintainer, CCIM is a Commercial Investment Advisor and the Principal of Visintainer Group in Fresno, CA. Formed in 2018 and built on a foundation of investment real estate, the Visintainer Group is a client-first commercial real estate firm. The Group has executed over $790 million in transactions across the United States. Brett specializes in commercial property acquisitions and dispositions and 1031 exchanges for owners in the Central Valley, Sacramento, and Central Coast markets. He can be reached at 559.890.0320 or brett@visintainergroup.com.